Cross-Chain Bridging: How to Move Crypto Between Blockchains Safely

Learn how to bridge crypto between blockchains safely. Compare top bridges, avoid security risks, and master cross-chain transfers with our complete 2026 guide.

The blockchain ecosystem has evolved into a multichain reality where assets, liquidity, and users are scattered across dozens of networks. Cross-chain bridges have become essential infrastructure, enabling you to move tokens between Ethereum, Arbitrum, Optimism, Base, Solana, and countless other chains. However, bridges have also been responsible for some of crypto's most devastating hacks, with over $2.5 billion stolen from bridge exploits between 2021 and 2024. This guide will teach you how bridges actually work, which ones to trust, and how to move your assets safely across chains.

TL;DR - The Quick Takeaways

- Bridges solve blockchain isolation - Without them, your ETH on Ethereum cannot interact with protocols on Arbitrum or Solana

- Different bridge types have different trust assumptions - Lock-and-mint bridges are simpler but require trusting validators; liquidity pool bridges are faster but may have slippage

- Security should be your top priority - Over $2.5B has been stolen from bridge hacks; always verify bridge legitimacy and use established protocols

- Top bridges in 2026 include Stargate, Across Protocol, Hop Protocol, and LayerZero-powered bridges for most EVM chains

- Always start with small test transactions - Bridge a minimal amount first to verify the route works before moving significant funds

- Gas costs vary significantly - Bridging to L2s is usually cheap, but bridging from L2s back to Ethereum mainnet can be expensive and slow

Table of Contents

- Why Do Blockchain Bridges Exist?

- How Do Cross-Chain Bridges Work?

- Types of Bridges: Trusted vs Trustless

- Major Bridges Compared

- Step-by-Step: How to Bridge Crypto Safely

- Bridge Security: Historical Hacks and Lessons

- How to Evaluate Bridge Safety

- Gas Optimization When Bridging

- Common Mistakes and Troubleshooting

- Frequently Asked Questions

Why Do Blockchain Bridges Exist?

Blockchains are fundamentally isolated systems. When Satoshi created Bitcoin and Vitalik built Ethereum, each network was designed as a sovereign, self-contained ledger. Your ETH on Ethereum has no native way to "know about" or interact with Solana, and your SOL cannot natively participate in Ethereum DeFi.

This isolation creates real problems:

Liquidity fragmentation - Instead of one unified market, liquidity is scattered across chains. A DEX on Arbitrum might have deep ETH/USDC liquidity while the same pair on Base has less, leading to worse prices.

User friction - If you hold assets on Ethereum but want to use a protocol on Optimism, you need a way to move those assets. Without bridges, you'd have to sell on a centralized exchange and re-buy on another chain.

Capital inefficiency - Projects deploying on multiple chains often need separate liquidity pools on each, multiplying their capital requirements.

Bridges solve these problems by creating mechanisms to move value between chains, essentially creating "tunnels" through the walls separating blockchain ecosystems.

How Do Cross-Chain Bridges Work?

Understanding bridge mechanics helps you evaluate their security and choose the right one for your needs. There are three primary technical approaches:

Lock-and-Mint Model

The most common bridge design works like this:

- You send tokens to a smart contract on the source chain (e.g., Ethereum)

- The bridge's validators observe this deposit

- Once confirmed, validators authorize minting of "wrapped" tokens on the destination chain

- You receive wrapped tokens (e.g., WETH) on the destination chain

When you bridge back, the process reverses: wrapped tokens are burned, and original tokens are unlocked.

Example: Wormhole uses this model. When you bridge ETH to Solana, your ETH is locked in Wormhole's Ethereum contract, and Wormhole-wrapped ETH is minted on Solana.

Trade-offs: Simple and capital-efficient, but you're trusting the bridge validators. If they're compromised, attackers can mint unbacked tokens.

Burn-and-Mint Model

Similar to lock-and-mint, but used for tokens that exist natively on multiple chains:

- Tokens are burned (destroyed) on the source chain

- Validators confirm the burn

- Equivalent tokens are minted on the destination chain

Example: Circle's Cross-Chain Transfer Protocol (CCTP) for native USDC works this way. USDC is burned on one chain and minted on another, with Circle acting as the trusted validator.

Liquidity Pool Model

Instead of locking/minting, these bridges use liquidity pools on both chains:

- You deposit tokens into a pool on the source chain

- You withdraw equivalent tokens from a pool on the destination chain

- Liquidity providers earn fees for providing capital on both sides

Example: Stargate Finance and Hop Protocol use this model.

Trade-offs: No wrapped tokens (you receive native assets), faster finality, but subject to slippage if pools are imbalanced. Liquidity providers take on risk.

Intent-Based Bridges

A newer model gaining popularity in 2025-2026:

- You express an "intent" to bridge (e.g., "I want 1 ETH on Arbitrum")

- Solvers compete to fulfill your intent

- The fastest/cheapest solver fronts you tokens on the destination chain

- The solver is reimbursed from your source chain deposit

Example: Across Protocol uses an intent-based system with relayers.

Trade-offs: Often fastest and cheapest, but relies on active solver/relayer network.

Types of Bridges: Trusted vs Trustless

Beyond technical mechanisms, bridges differ in their trust assumptions:

Trusted (Centralized) Bridges

These bridges rely on a central party or small validator set to verify cross-chain transactions.

Characteristics:

- Faster and often cheaper

- Trust assumptions similar to centralized exchanges

- If validators collude or are compromised, user funds are at risk

Examples: Multichain (defunct after hack), most centralized exchange bridges

Trust-Minimized Bridges

These bridges use cryptographic proofs or larger validator sets to reduce trust requirements.

Characteristics:

- Use light clients, optimistic verification, or zero-knowledge proofs

- Slower but more secure

- May still have some trust assumptions (e.g., honest majority of validators)

Examples: Native rollup bridges (Arbitrum, Optimism official bridges), IBC for Cosmos chains

Decentralized Bridge Networks

Protocols that create open networks for cross-chain messaging.

Characteristics:

- Anyone can run a relayer/validator

- Economic incentives align participants

- Security scales with network size and stake

Examples: LayerZero, Axelar, Chainlink CCIP

| Bridge Type | Speed & Cost | Trust & Best For |

|---|---|---|

| Trusted/Centralized | Fast, Low cost | High trust required; small, time-sensitive transfers |

| Native Rollup | Slow (7 days), Variable | Minimal trust; maximum security needs |

| Liquidity Pool | Fast, Medium cost | Moderate trust; regular DeFi users |

| Intent-Based | Very fast, Competitive | Moderate trust; best UX and speed |

Major Bridges Compared

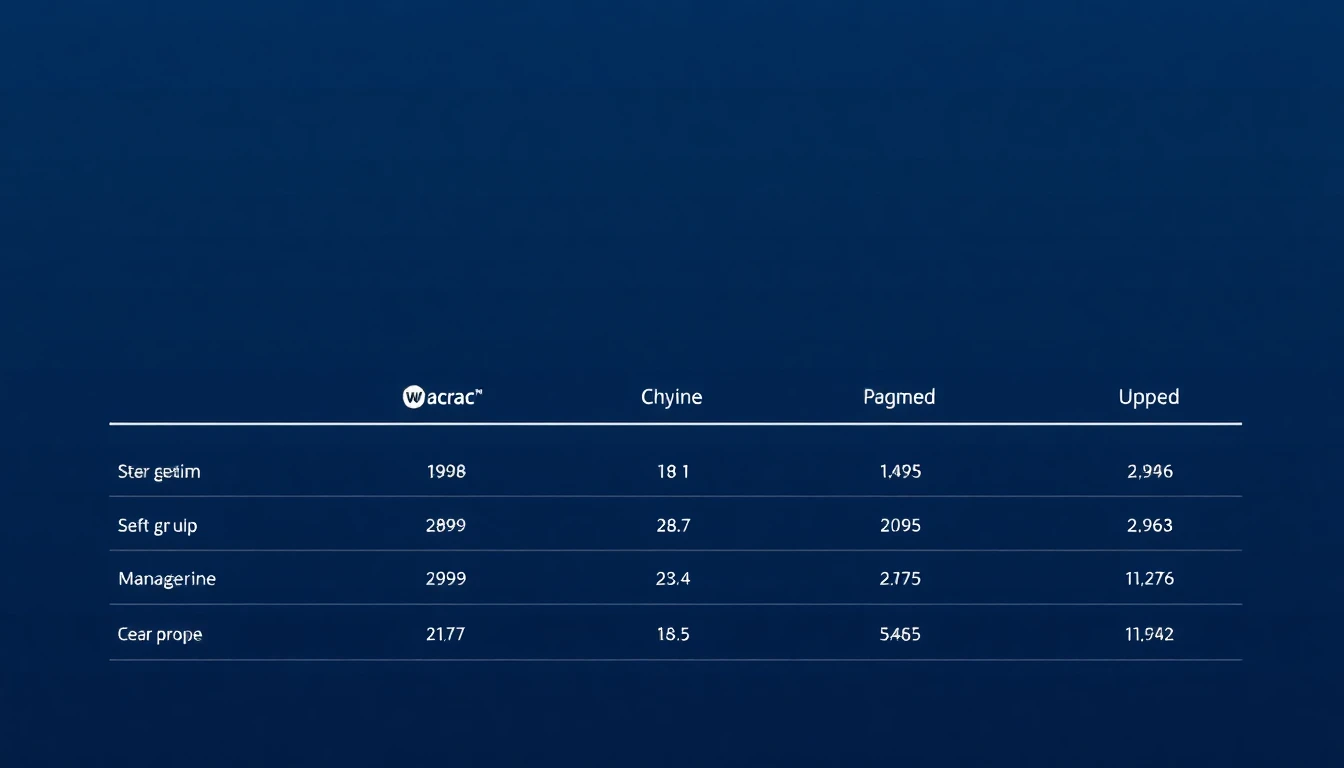

Here's an overview of the most reliable bridges in 2026:

Stargate Finance

Chains: Ethereum, Arbitrum, Optimism, Base, Polygon, Avalanche, BNB Chain, and 15+ others

Mechanism: Unified liquidity pools powered by LayerZero

Pros:

- Native assets (no wrapped tokens)

- Deep liquidity on major routes

- Instant guaranteed finality

Cons:

- Slippage on large transfers or imbalanced pools

- Fees can be higher during congestion

Best for: Moving stablecoins and ETH between major EVM chains

Across Protocol

Chains: Ethereum, Arbitrum, Optimism, Base, Polygon, zkSync, Linea

Mechanism: Intent-based with optimistic verification

Pros:

- Extremely fast (often under 1 minute)

- Competitive fees

- Capital-efficient design

Cons:

- Fewer chains than some competitors

- Relayer availability affects speed

Best for: Fast bridging between Ethereum and L2s

Hop Protocol

Chains: Ethereum, Arbitrum, Optimism, Base, Polygon, Gnosis

Mechanism: Liquidity pools with Bonders providing speed

Pros:

- Battle-tested since 2021

- Good for frequent L2 users

- Native token incentives

Cons:

- Limited chain support

- Variable fees based on liquidity

Best for: Regular transfers between Ethereum L2s

LayerZero (Omnichain Messaging)

Chains: 50+ chains including EVM and non-EVM

Mechanism: Messaging protocol that apps build on (not a bridge itself)

Pros:

- Most extensive chain coverage

- Powers many bridge applications

- Flexible security configurations

Cons:

- Security depends on how apps configure it

- Not a direct user-facing bridge

Best for: Developers building cross-chain apps; users access via apps like Stargate

Wormhole

Chains: 30+ chains including Solana, Ethereum, Cosmos chains, Sui, Aptos

Mechanism: Guardian network validates cross-chain messages

Pros:

- Best for non-EVM chains (Solana especially)

- Large ecosystem of integrated apps

- Recovered from 2022 hack, improved security

Cons:

- History of major exploit ($325M in 2022)

- Wrapped assets on most routes

Best for: Bridging to/from Solana and other non-EVM chains

Native Rollup Bridges

Examples: Arbitrum Bridge, Optimism Gateway, Base Bridge

Mechanism: Built into the rollup's security model

Pros:

- Highest security (inherits L1 security)

- No additional trust assumptions

- Usually cheapest for L1 → L2

Cons:

- L2 → L1 withdrawals take 7 days (optimistic rollups)

- Only works for that specific rollup

Best for: Moving large amounts with maximum security when time isn't critical

Step-by-Step: How to Bridge Crypto Safely

Let's walk through a practical bridging example using Across Protocol to move ETH from Ethereum to Arbitrum.

Before You Start: Pre-Bridge Checklist

- Verify the official URL - Bookmark official bridge sites. Never click links from Discord/Twitter/Telegram

- Check your wallet - Ensure you have enough ETH for gas on the source chain

- Verify destination address - You'll receive tokens at the same address on the destination chain (for EVM chains)

- Check bridge status - Ensure the bridge is operational and not paused

Step 1: Connect to the Official Bridge

Navigate directly to the official Across Protocol website. Verify the URL carefully—phishing sites often use similar domains.

Connect your wallet (MetaMask, Rabby, etc.). The bridge will detect your current network.

Step 2: Select Your Route

- From: Ethereum Mainnet

- To: Arbitrum One

- Token: ETH

- Amount: Enter the amount you want to bridge

Warning: Always start with a small test transaction when using a bridge for the first time. Bridge $5-10 worth first to verify everything works before moving larger amounts.

Step 3: Review the Quote

The bridge will display:

- Amount you'll receive (after fees)

- Estimated time (usually 1-10 minutes for Across)

- Gas cost on the source chain

- Bridge fee (goes to relayers/LPs)

Check that the received amount matches your expectations. Significant slippage indicates potential issues.

Step 4: Approve and Execute

If bridging an ERC-20 token (not native ETH), you'll need to approve the bridge contract first. For ETH/native tokens, skip to the bridge transaction.

Click "Bridge" or "Transfer" and confirm the transaction in your wallet.

Step 5: Track Your Transfer

Most bridges provide a transaction tracker. Save the transaction hash. You can also track on:

- The bridge's native interface

- Block explorers for both chains

- Aggregators like Socket or LI.FI

Step 6: Receive Funds on Destination Chain

Switch your wallet to the destination network (Arbitrum in this example). Your funds should appear within the estimated time.

If funds don't arrive, don't panic—check the transaction status on the bridge's tracker before taking any action.

Important: After bridging, verify you received the correct token type. Some bridges give you wrapped versions that may need unwrapping to use in certain protocols.

Bridge Security: Historical Hacks and Lessons

Bridges have been crypto's biggest attack vector. Understanding past exploits helps you avoid risky bridges.

Ronin Bridge Hack (March 2022) - $625 Million

What happened: Attackers (linked to North Korean Lazarus Group) compromised 5 of 9 validator keys for Axie Infinity's Ronin bridge. With majority control, they authorized fraudulent withdrawals.

Root cause: Overly centralized validator set; 4 keys controlled by one entity (Sky Mavis).

Lesson: Avoid bridges with small or centralized validator sets. Check how many validators secure the bridge and who controls them.

Wormhole Hack (February 2022) - $325 Million

What happened: A smart contract vulnerability allowed attackers to mint 120,000 wETH on Solana without depositing equivalent ETH on Ethereum.

Root cause: A signature verification bypass in the Solana-side contract.

Lesson: Smart contract bugs can be catastrophic. Prioritize bridges with multiple audits and bug bounty programs. Jump Crypto covered Wormhole's losses, but users shouldn't rely on bailouts.

Nomad Bridge Hack (August 2022) - $190 Million

What happened: A routine upgrade introduced a vulnerability that let anyone copy successful transaction data and replay it with their own address. Once discovered, hundreds of wallets exploited it in a "crowd-sourced" hack.

Root cause: An initialization bug made the Merkle root default to 0x0, validating arbitrary messages.

Lesson: Even "routine" upgrades can introduce critical bugs. Be cautious using bridges immediately after upgrades—wait for community validation.

Multichain Incident (July 2023) - $126 Million+

What happened: Funds moved from Multichain without clear explanation. The team's CEO was reportedly detained by Chinese authorities, and the bridge mysteriously drained.

Root cause: Centralization risk—one person controlled critical infrastructure.

Lesson: Understand the human/operational security of a bridge, not just smart contracts. If a project's leadership is concentrated or opaque, funds are at risk.

| Bridge Hack | Amount Lost | Primary Cause | Status |

|---|---|---|---|

| Ronin | $625M | Centralized validators | Repaid by Sky Mavis |

| Wormhole | $325M | Smart contract bug | Covered by Jump Crypto |

| Nomad | $190M | Upgrade introduced bug | Partial recovery ongoing |

| Multichain | $126M+ | Operational/custody | No recovery |

How to Evaluate Bridge Safety

Before using any bridge, run through this security checklist:

1. Check Total Value Locked (TVL) and History

Higher TVL generally indicates community trust, but isn't everything. Check:

- Current TVL on DefiLlama

- How long the bridge has operated

- Whether TVL has been stable or volatile

2. Verify Audit History

Look for:

- Multiple audits from reputable firms (Trail of Bits, OpenZeppelin, Spearbit, Zellic)

- Recent audits (within last 6 months)

- Public audit reports you can read

- Bug bounty program (Immunefi, etc.)

3. Understand the Trust Model

Ask:

- How many validators/guardians secure the bridge?

- Who runs them? (Named entities vs anonymous)

- What's the threshold for approving transactions?

- Is there a multisig? What's the composition?

4. Check for Insurance/Recovery Plans

Some bridges offer:

- Insurance fund for hacks

- Backing from major funds (like Jump backing Wormhole)

- Clear incident response procedures

5. Review Community Reputation

- Search for past incidents on Twitter, Discord

- Check if the team is doxxed and reputable

- Look for red flags in community discussions

6. Verify the Contract Addresses

- Use official documentation to verify contract addresses

- Check that addresses match on block explorers

- Never use contract addresses shared in chat/DMs

Security Rule: If a bridge seems too good to be true (extremely low fees, massive APY for LPs, or unknown team), treat it as high-risk. The yield isn't worth losing your principal.

Gas Optimization When Bridging

Bridging costs include source chain gas, bridge fees, and sometimes destination chain gas. Here's how to minimize them:

Time Your Bridges

Gas prices fluctuate significantly. For Ethereum:

- Cheapest: Weekends, late night/early morning UTC

- Most expensive: US market hours, during major NFT mints or market volatility

Use gas trackers like Etherscan Gas Tracker or GasNow to monitor prices.

Choose Routes Wisely

Sometimes indirect routes are cheaper:

- Direct: Ethereum → Arbitrum (one bridge transaction)

- Indirect: Ethereum → Arbitrum → Base (might be cheaper than Ethereum → Base directly)

Aggregators like Socket, LI.FI, and Jumper calculate optimal routes automatically.

Batch Transactions When Possible

If you're moving multiple tokens:

- Some bridges support multiple assets in one transaction

- Moving everything at once saves on base gas costs

Use Native Bridges for L1 → L2

Official rollup bridges are often cheapest for depositing to L2s:

- No bridge fee (only gas)

- Gas is usually lower since L2s subsidize onboarding

The tradeoff: Withdrawals back to L1 take 7 days for optimistic rollups.

Consider Chain-Native Stablecoins

Instead of bridging USDC, consider:

- Using Circle's CCTP for native USDC bridging

- Swapping to destination chain's native stablecoin if liquidity supports it

| Optimization Strategy | Potential Savings | Best For |

|---|---|---|

| Off-peak timing | 30-70% on gas | Large transfers |

| Route optimization | 10-30% on fees | Any transfer |

| Native bridges for deposits | Bridge fee elimination | L1 → L2 transfers |

| Aggregator comparison | 5-20% total cost | Finding best rates |

Common Mistakes and Troubleshooting

Mistake 1: Wrong Network/Address

Problem: Sent tokens to wrong network or incompatible address

Prevention:

- Triple-check network selection before confirming

- For EVM chains, same address works across networks

- For non-EVM (Solana, Cosmos), addresses are completely different formats

If it happens: Tokens sent to wrong EVM network are usually recoverable by switching networks. Tokens sent to non-EVM addresses may be lost forever.

Mistake 2: Insufficient Gas on Destination Chain

Problem: Tokens arrive but you can't use them because you have no native gas token

Prevention:

- Many bridges offer gas drops (small amount of native token)

- Keep small amounts of gas tokens on chains you use

- Use "refuel" services like Bungee Refuel

Mistake 3: Using Phishing Sites

Problem: Approved malicious contract that drains wallet

Prevention:

- Bookmark official URLs

- Verify addresses match official docs

- Never click bridge links from social media

- Use URL verification tools

If it happens: Immediately revoke approvals using Revoke.cash. Transfer remaining funds to a new wallet.

Mistake 4: Not Waiting for Confirmations

Problem: Assumed bridge failed and retried, causing double-spend confusion

Prevention:

- Bridges show estimated times—wait for that duration

- Check transaction on block explorer before assuming failure

- Contact support before retrying

Mistake 5: Bridging Unsupported Tokens

Problem: Bridged a token the destination chain doesn't properly support

Prevention:

- Verify token is listed in bridge's supported assets

- Check destination chain has liquidity for that token

- Some tokens have different addresses/versions on different chains

Troubleshooting: Stuck Transactions

If your bridge transfer seems stuck:

- Check transaction status on source chain explorer—did it confirm?

- Check bridge's transfer tracker with your transaction hash

- Wait the full estimated time plus buffer (bridges can be slow during congestion)

- Check bridge's Discord/status page for known issues

- Contact support with transaction hash if nothing else works

Most "stuck" transactions are just delayed. True failures are rare on established bridges.

Frequently Asked Questions

How long does bridging take?

Depends on the bridge and route:

- Intent-based bridges (Across): 1-10 minutes

- Liquidity pool bridges (Stargate, Hop): 2-20 minutes

- Native rollup bridges (Arbitrum, Optimism): Deposits: 10-15 minutes; Withdrawals: 7 days

- Non-EVM bridges (Wormhole): 15-30 minutes

Are bridges safe?

Bridges have inherent risks—they're high-value targets holding large amounts of crypto. However, established bridges with strong security practices, multiple audits, and long track records are reasonably safe for typical use. Never keep large amounts sitting in bridge contracts longer than necessary.

What's the cheapest way to bridge?

Use aggregators like Jumper, Socket, or LI.FI to compare routes. Generally:

- L1 → L2: Use native rollup bridges

- L2 → L2: Use intent-based bridges like Across

- Large amounts: Native bridges despite delay (saves fees)

- Small amounts: Whatever has lowest minimum/fees

Can I bridge any token?

Not all tokens are supported on all routes. Major tokens (ETH, USDC, USDT, WBTC) are widely supported. Lesser-known tokens may only be bridgeable via specific routes or may require swapping first.

What happens if a bridge gets hacked while my funds are in transit?

This is the nightmare scenario. If you've initiated a transfer:

- Completed transfers (tokens received) are safe

- In-transit transfers may be at risk depending on the exploit

- Source chain deposits may be recoverable if destination wasn't compromised

This is why minimizing time-in-bridge and using established bridges matters.

Should I use centralized exchanges to bridge instead?

CEX bridging (deposit on one chain, withdraw on another) is a valid option:

- Pros: Battle-tested security, usually fast, often cheapest for large amounts

- Cons: Requires KYC, custody risk, withdrawal limits, not available for all chains/tokens

For large amounts, CEX bridging may actually be safer than bridge protocols.

Sources and Attribution

This guide synthesizes information from the following sources:

- Bridge Documentation: Official docs from Stargate, Across, Hop, Wormhole, LayerZero

- Security Research: Rekt News for hack post-mortems, Chainalysis bridge security reports

- Data Sources: DefiLlama for TVL data, L2Beat for rollup bridge information

- Technical References: Ethereum Foundation documentation on bridges, Vitalik Buterin's writings on cross-chain security

- Industry Analysis: Messari bridge reports, Delphi Digital cross-chain research

For the latest bridge security assessments and TVL data, consult:

- DefiLlama Bridges

- L2Beat

- Rekt News for security incident coverage

Cross-chain bridging is essential infrastructure for the multichain future, but it comes with real risks. Always prioritize security over convenience, start with small amounts, and stick to battle-tested bridges. The few extra minutes spent verifying a bridge's legitimacy could save you from catastrophic loss.

What's Next?

Disclaimer: This guide is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk. Always do your own research before making investment decisions.